Bookkeeping for Mompreneurs and Women-Owned Businesses

Taking your business to the next level can be a struggle

-

- How do I increase profits and cash?

- Is there a better way to track jobs and inventory?

- How do I improve reports?

- What is holding my business back from growing?

That’s why we specialize in providing bookkeeping and advisory services to women-owned businesses.

Our mission is to improve your accounting processes and maximize your bottom line. Our Signature three-part process takes your business to the next level.

Our Signature Process

Our proven Signature three-step process takes your business to the next level.

Diagnostic Review and Update

Increasing your profits and cash flow means ensuring your financial foundations are stable. We’ll do a complete diagnostic review, clean up any problems, and catch up on any outstanding transactions.

Implement Processess and Procedures

With the foundations in place, we can now provide data-rich reports and the know-how to understand them. Up-to-date, comprehensive reporting gives you clarity on the performance of your business.

Management and Growth

Time to take your business to the next level! With your foundations in place and reports setup, we can now advise you on what is needed to increase your company’s profits and performance and help you grow.

You have made my small business life so much easier. Thank you so much!

Amanda was such a joy to work with! She has a lot of knowledge and is so patient.

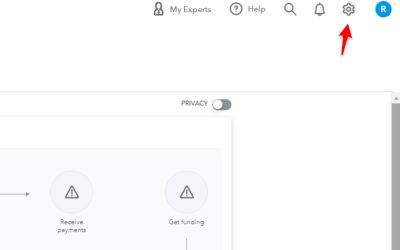

How to add your bookkeeper to QuickBooks as an Accounting User

Internet browser QuickBooks login and password Email of your bookkeeper Sign in to your QuickBooks...

4 Types of Business Owners Who Need Bookkeeping Help

Managing a business is no easy task, and bookkeeping can often feel overwhelming. Here are four...

Empowering Women Entrepreneurs

From Mompreneur to Mogul: The Role of Strategic Bookkeeping in Achieving Financial...

Year End Bookkeeping Checklist

As the year winds down, it’s the perfect time to tidy up your books and get ahead for tax season....

The Three Financial Statements Every Business Owner Needs to Understand

“Discover the three essential financial statements every small business owner needs to understand—balance sheet, income statement, and cash flow statement. Learn how each one provides critical insights for informed decision-making, and explore options to get professional support or DIY your bookkeeping with our exclusive tracker!”

I used to be so cringe …

How to avoid a cringe moment like this: Something embarrassing happened to me once… And I’m...

The Myth that only Large Businesses Need Bookkeeping

Many small business owners believe bookkeeping is only necessary for large companies, but this isn’t true. Accurate bookkeeping is essential for businesses of all sizes, including solo entrepreneurs. It simplifies tax filing, provides insights into cash flow, ensures compliance with payroll and tax laws, and helps identify unnecessary expenses. Proper bookkeeping serves as the financial foundation for any business, enabling growth and profitability.

Looking to take the confusion out of bookkeeping?

Our latest resource, The Beginner’s Guide to Bookkeeping, is just what you need! Download our handy guide today and understand your bookkeeping like a pro.