Planning

A mid-year financial assessment is the best way to evaluate whether or not you are on target to hit your goals. It’s also the perfect time to pivot if you’ve gotten off track. However, to point yourself back in the right direction, you have to know where you’re currently standing:

Check-in With Yourself. First and foremost, how are you feeling about your business at the mid-year mark? Do you feel like you’re on your way to achieving whatever it was you originally set out to achieve? If not, this is a great time to get clear on whether you’re running your business or whether your business is running you.

Revisit Your Budget. The mid-year check-in provides a perfect budget review opportunity. Take a look at what you forecasted for the year in terms of revenue and expenses.

Review Your Financial Statements. Profit and loss statements, balance sheets, and cash flow statements are standard financial documents to review during a financial checkup. Compare your financials right now to your financials from this time last year to trends and cycles.

Evaluate Your Goal Progression. Remember those goals you set for your business at the start of the year? It’s time to see where you’re at in meeting them. Whether you set concrete financial milestones or identified systems and processes you wanted to employ, take some time to see if you’ve made meaningful strides toward getting there.

Check-in On Your Taxes. This is a good time to make adjustments to your 3rd and 4th quarter estimated payments if you’re forecasting an increase in revenue for the second half of the year. If you haven’t made your estimated tax payments, then it might be worth scheduling an appointment with your tax professional. Putting off making tax payments causes unnecessary stress. Attending to taxes all year can make for an easier, less stressful spring.

Building good habits as an entrepreneur, like running a mid-year financial checkup, is critical to the success of your business. But habits aren’t always easy to establish or maintain. Maybe you don’t even know where to start. If your business needs support, contact us today to schedule a consultation.

Planning

The last six months are a great opportunity to reflect on achievements, reassess goals, and lay the groundwork for a successful year-end. To make the most of this time, it is essential to identify key focus areas that can help move your business forward. Here are 4 crucial aspects that businesses should prioritize during the last six months of the year.

Goal Review and Adjustment

Begin by evaluating the goals you set at the beginning of the year. Determine what progress has been made and identify any adjustments needed to align with current market conditions and evolving business dynamics. This assessment will provide a clear roadmap for the next six months.

Client Engagement and Retention

Focus on nurturing existing customer relationships. Implement targeted marketing campaigns and personalized communication to engage customers and encourage repeat business. Leverage customer feedback to identify areas for improvement and enhance the overall customer experience.

Operational Efficiency

Streamline internal processes and optimize efficiency across departments. Evaluate workflows, identify bottlenecks, and implement automation or technology solutions to enhance productivity. Focus on cost management and identify areas for potential savings without compromising quality.

Financial Management

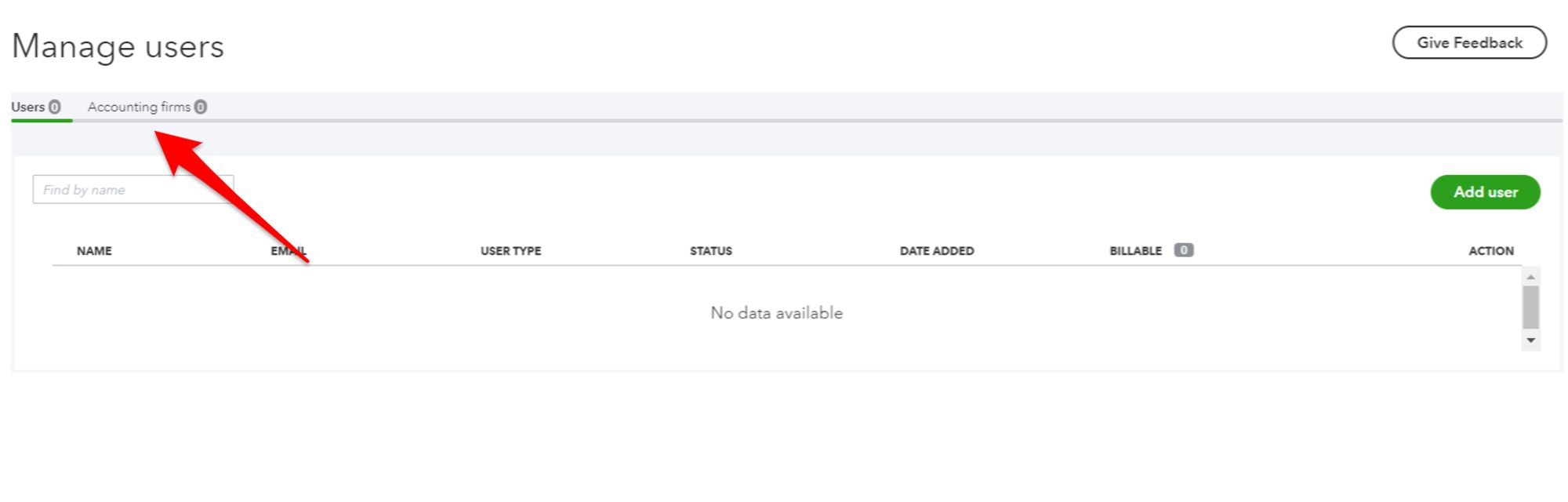

Pay close attention to financial performance and cash flow management. Review budgets, track expenses, and ensure proper accounting practices. Prepare for tax season in advance, engage with your bookkeepers or accountant, and explore opportunities to optimize revenue generation.

The last six months of the year are a valuable opportunity to drive growth and position your business for success. By focusing on key areas such as goal review, customer engagement, operational efficiency, and financial management, you can set the stage for a strong finish to the current year and a promising start to the next. To learn more about how we can help manage and keep your finances organized through the rest of the year, schedule a call with us today.

Bookkeeping

As a small business owner, accounting is critical to running your business. It’s essential to keep your financial records accurate and up-to-date to make informed decisions, save money on taxes, and ensure your business’s long-term success. However, accounting mistakes are common, and they can be costly, both financially and legally. In this blog post, we’ll discuss some of the most dangerous accounting mistakes you should avoid keeping your small business on track.

Mixing Personal and Business Expenses

One of the most common accounting mistakes small business owners make is mixing personal and business expenses. This practice can create a mess in your bookkeeping, making it difficult to accurately track your business’s financial performance. It can also create tax implications, leading to an audit or penalties.

To avoid this mistake, always separate your business and personal finances. Have separate bank accounts, credit cards, and accounting software for your business and personal expenses. This way, you can track your business transactions efficiently, and when tax time comes, you won’t have to spend hours sorting out which expenses are business-related.

Failing to Keep Accurate Records

Another dangerous accounting mistake is failing to keep accurate financial records. With proper record-keeping, you will know how much money is coming in and going out of your business, making it easier to make informed financial decisions.

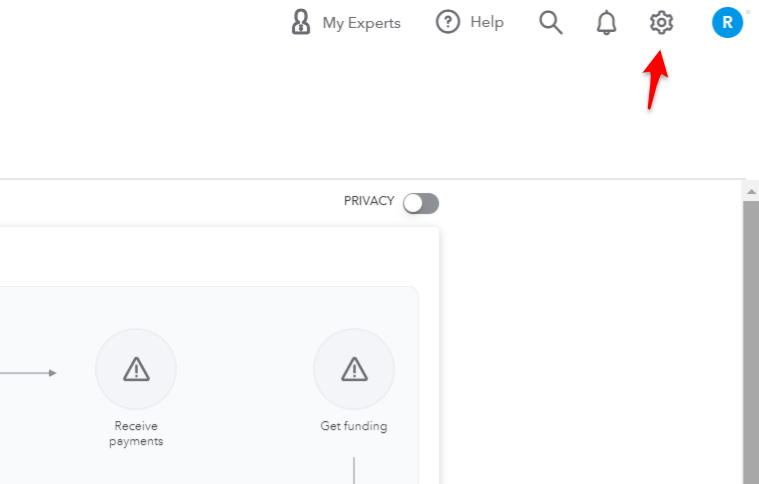

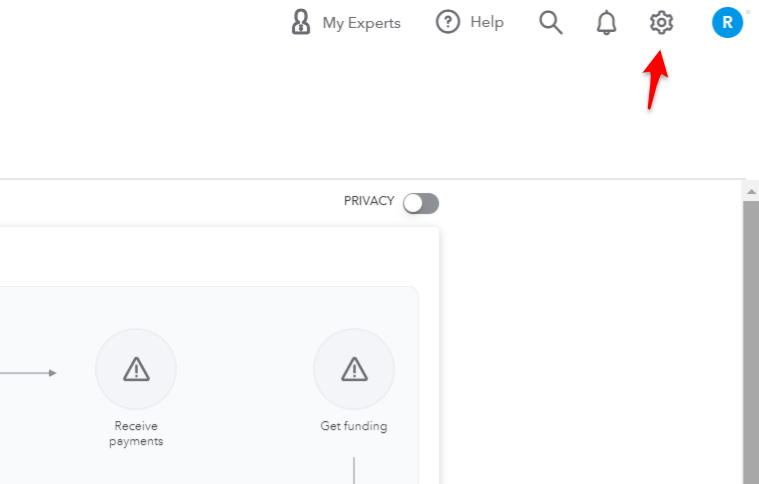

To avoid this mistake, keep track of all your business transactions. Use accounting software to record sales, expenses, and other financial transactions. Make sure to reconcile your bank and credit card statements regularly to ensure that all transactions are accounted for and that there are no discrepancies. A QuickBooks ProAdvisor like we have here at Amanda Saye Bookkeeping Services will check for these discrepancies and keep the accounts separate.

Ignoring Tax Obligations

Taxes are critical to running a small business; ignoring your tax obligations can lead to severe consequences. Failure to pay taxes or file tax returns on time can lead to fines, penalties, or legal action.

To avoid this mistake, keep track of all your tax obligations, including sales, payroll, and income taxes. Please file all necessary tax returns on time and pay any taxes owed as soon as possible.

Misclassifying Workers

Another common accounting mistake is misclassifying workers as independent contractors instead of employees. This mistake can lead to tax implications, including fines, penalties, and legal action.

How to understand the difference between employees and independent contractors to avoid this mistake? Employees are typically under your control, and you’re responsible for paying their payroll taxes, providing benefits, and following labor laws. On the other hand, independent contractors work for themselves and are responsible for their taxes and benefits.

Not Reconciling Accounts

Not reconciling your accounts is another dangerous accounting mistake. Reconciliation involves matching your accounting records with your bank and credit card statements to ensure that all transactions are accounted for and accurate.

To avoid this mistake, reconcile your bank and credit card statements regularly. This way, you can catch any errors or discrepancies early and take corrective action before they become a more significant issue.

In conclusion, accounting mistakes can be costly and have severe consequences for your small business. However, avoiding these dangerous accounting mistakes allows you to keep your finances in order, make informed financial decisions, and ensure your business’s long-term success. If you need more clarification about your accounting practices, contact us HERE to help you get on track.

Uncategorized

Summer is in full swing. The first thing most business owners avoid when the weather improves is generally the tedious things. Like staying on top of your bookkeeping and financials. But as the summer sun shines bright, it’s important to keep your business’s financial records just as radiant. So, we’ve put together some helpful tips to ensure your bookkeeping stays on track during the sunny season.

Streamline your expense tracking

Whether it’s business trips, conferences, team outings, or summer promotions, make sure to accurately record all expenses and keep receipts organized. This will simplify your bookkeeping process and make tax time a breeze.

Embrace cloud-based bookkeeping

Take advantage of cloud-based accounting software like QuickBooks Online, which enables you to access your financial data securely from anywhere. This flexibility allows you to enjoy your summer adventures while staying connected to your business’s financial health.

Review your budget

Summer often brings unique business opportunities and challenges. Take time to reassess your budget and adjust your financial goals for the upcoming months. Ensure you allocate resources strategically to make the most of the season’s potential.

Stay on top of invoicing

Don’t let delayed payments disrupt your summer flow. Send out invoices promptly and follow up with any overdue payments. Maintaining a healthy cash flow is crucial for a successful season.

Remember, even during the summer, your business’s financial well-being deserves attention. Implement these tips to maintain smooth bookkeeping practices and enjoy a stress-free summer.

If you don’t want to handle any of your bookkeeping over the summer, then a great option is to hire us to do it for you! Then you really can have your cake and eat it too. Get in touch with us today.

Recent Comments