The Accounting Field

A bookkeeper and accountant work with financial records, but they have different roles and responsibilities within an organization. Here are some key differences between the two:

- Scope of work: Bookkeepers typically focus on the day-to-day financial transactions of a business, while accountants may take on a wider range of financial tasks, such as preparing tax returns, developing financial strategies, and providing financial advice.

- Level of education and training: Accountants typically have more education and training than bookkeepers. I

- Role in the organization: Bookkeepers may work as part of a team or independently, while accountants may hold higher-level positions within an organization and have supervisory responsibilities.

- Relationship with clients: Bookkeepers may have a more hands-on role with clients, working closely with them to track and manage their financial records. Accountants may have more of a consultative role, providing financial advice and guidance to clients.

Overall, the main difference between a bookkeeper and an accountant is the level of education, training, and responsibility. While bookkeepers handle the day-to-day financial transactions of a business, accountants have a broader range of skills and responsibilities and often work at a higher level within an organization.

Uncategorized

As the summer season approaches, it’s important for business owners to consider tax planning strategies that can lead to significant savings. By taking advantage of available deductions, credits, and smart financial practices, you can optimize your tax situation and make the most of the sunny season.

Here are some essential tax tips and strategies to keep in mind:

Deduct Summer Business Travel: If you are a business owner or self-employed, summer business travel can be deductible. Keep accurate records of all business-related expenses, including transportation, lodging, meals, and conference fees.

Take Advantage of the Child and Dependent Care Tax Credit: For parents with children attending summer camps or daycare, the Child and Dependent Care Tax Credit can provide valuable savings. This credit can be claimed for a percentage of qualifying expenses, allowing parents to work or look for employment while their children are in care.

Consider Home Office Deductions: If you work from home, you may be eligible for home office deductions. Ensure that your workspace meets the IRS criteria for a home office and keep detailed records of expenses related to your workspace, such as utilities, internet, and office supplies.

Track Summer Charitable Donations: Summer is a time when many people engage in philanthropic activities and donate to charitable organizations. Keep track of all donations made during the summer months, including cash, goods, or volunteer-related expenses, as they may be tax-deductible.

By implementing these tax tips and strategies, you can make the most of the summer season while minimizing your tax burden. Remember to consult with a tax professional for personalized advice based on your unique circumstances and business. Stay proactive, organized, and informed to maximize your tax savings and enjoy a stress-free summer of financial well-being.

Uncategorized

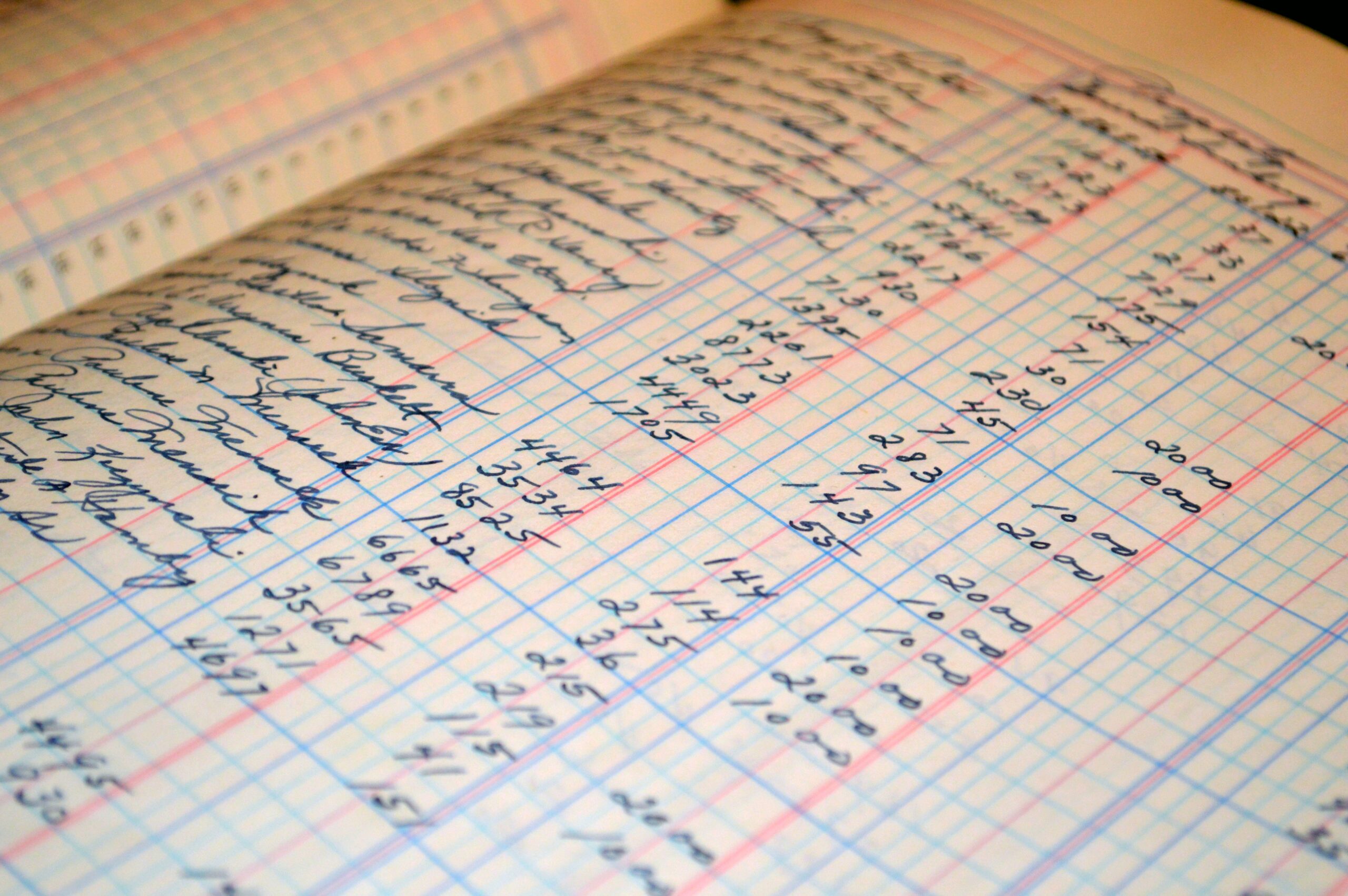

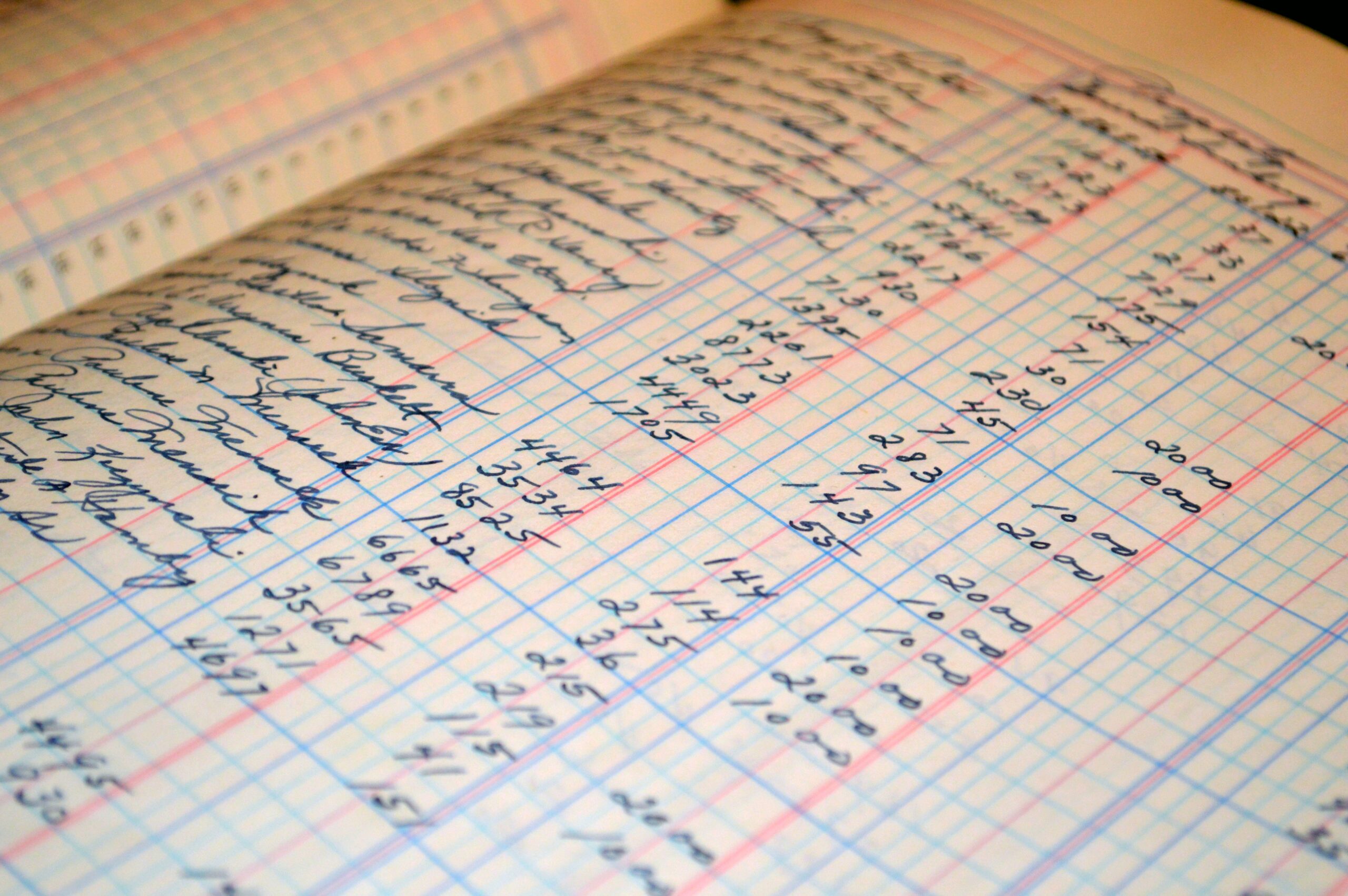

A bookkeeper is a vital business team member, responsible for accurately recording and tracking financial transactions, preparing financial reports, managing accounts payable and accounts receivable, reconciling bank statements, and assisting with tax preparation.

In addition to these important tasks, a bookkeeper can help a business identify financial trends and patterns, improve cash flow management, reduce the risk of errors, support growth, and free up time for business owners to focus on other aspects of the business.

With their attention to detail, organizational skills, and expertise in working with numbers, bookkeepers play a crucial role in helping businesses stay financially healthy and successful.

Here are 10 reasons why YOU need a bookkeeper:

- To accurately record and track financial transactions: A bookkeeper can ensure that all financial transactions are recorded accurately and in a timely manner.

- To prepare financial reports: A bookkeeper can generate financial reports such as balance sheets, income statements, and cash flow statements, which can provide valuable insights into the financial health of a business.

- To manage accounts payable and accounts receivable: A bookkeeper can help a business manage its accounts payable (bills that need to be paid) and accounts receivable (money that is owed to the business).

- To reconcile bank statements: A bookkeeper can ensure that a business’s bank statements are accurate and up-to-date by reconciling them with the company’s financial records.

- To prepare for tax time: A bookkeeper can help a business stay organized and ensure all necessary documentation is in place for tax season.

- To identify financial trends and patterns: A bookkeeper can help a business identify trends and patterns that can inform decision-making and strategic planning by analyzing financial data.

- To improve cash flow management: A bookkeeper can help a business manage its cash flow more effectively by tracking expenses and identifying opportunities to reduce costs.

- To reduce the risk of errors: A bookkeeper can help reduce the risk of errors in financial recordkeeping, which can save a business time and money in the long run.

- To support growth: As a business grows, it may need more sophisticated financial management. A bookkeeper can help a business scale up its financial systems and processes.

- To free up time for business owners: By outsourcing bookkeeping tasks to a professional, business owners can focus on other aspects of their business, such as sales and marketing.

Uncategorized

As the sun shines brightly and the temperatures rise, summer presents the perfect opportunity for business owners to take a step back and conduct a thorough financial health check.

Assessing your business’s financial well-being during this season can provide valuable insights and help you make informed decisions for the rest of the year. Here are some key steps to consider in your summer financial assessment:

1. Start by analyzing your income and expenses for the first half of the year. Identify any trends or patterns, and compare the figures to your initial projections. This review will give you a clear picture of how your business is performing financially.

2. Review your profit margins and overall profitability. Identify areas where you can reduce costs or increase revenue. This assessment can help you fine-tune your pricing strategies and budget allocations.

3. Take the time to adjust your budget for the second half of the year based on your financial assessment. Account for any changes in income, expenses, or business goals. A well-adjusted budget will serve as a roadmap for the remainder of the year.

4. Consider gathering customer feedback on your products or services. Satisfied customers are more likely to become loyal, repeat customers. Address any concerns or suggestions to enhance customer satisfaction.

5. Engage with financial advisors or accountants to gain valuable insights and expert advice. Their expertise can help you make well-informed financial decisions and set your business up for success.

Conducting a summer financial health check allows you to identify strengths, weaknesses, and growth opportunities for your business. With this knowledge, you can proactively address any financial challenges and build a solid foundation for continued success throughout the year and beyond.

Looking for help with your business finances? We’ve been working with small business owners to free up more time, get more financial clarity, and create more cash flow in their businesses. Ready to learn more? Book a call to get started!

The Accounting Field, Uncategorized

Here are some of the things that financial reports can tell you:

- Income: Financial reports, such as income statements or profit and loss statements, can tell you how much money a business is making.

- Expenses: Financial reports can also tell you how much a business spends on various expenses, such as salaries, rent, and utilities.

- Profitability: Financial reports can tell you whether a business is profitable by comparing income and expenses.

- Cash flow: Financial reports can show how much cash a business has and how much cash flows in and out of the company.

- Assets: Financial reports can provide information on a business’s assets, such as property, equipment, and inventory.

- Liabilities: Financial reports can also tell you about a business’s liabilities, such as loans or outstanding payments.

- Equity: Financial reports can show how much equity a business has, representing the portion of the company that shareholders own.

Financial reports provide a snapshot of a business’s financial situation, which can help make decisions about investing, lending, or doing business with that company.

Recent Comments