I used to be so cringe …

How to avoid a cringe moment like this:

Something embarrassing happened to me once…

And I’m finally ready to talk about it.

Back then, I was cringing so badly and I didn’t want anyone to know about it.

Here’s what happened…

A while back, I was constantly dropping the ball on important tasks. I’d write things down on sticky notes, send myself reminder emails, or just keep a mental list of what I needed to do. I even bought a very cute spendy planner and spent way too much time making it cute. But inevitably, something would slip through the cracks—whether it was missing a client deadline, forgetting to follow up on an invoice, or overlooking a key project detail. It was chaos!

The worst part? It wasn’t that I didn’t have enough time—I just didn’t have a good system to manage everything.

Then, I found ClickUp, and it was a total game-changer. Once I started using it to organize all my tasks, set reminders, and track projects, I stopped relying on memory alone. Suddenly, I had a clear plan for my day, my week, and even my month. No more flipping through planner pages trying to find that ONE note that I needed for the project. No more missed tasks, no more last-minute scrambles.

I could easily have never spoken about it to anyone to save myself from getting more embarrassed…

But I actually learned a lot from it and it also helped me get where I am today.… And I wanted to spare you from the embarrassment in case you are making the same mistake.

Here’s what I gained from the experience:

- A reliable system beats memory every time: Relying on memory alone leads to missed tasks and unnecessary stress. Having a centralized system like ClickUp or Asana or Trello helps keep everything organized and visible.

- Automation saves time and prevents errors: Tools like ClickUp allow you to set reminders, assign due dates, and create workflows that ensure nothing slips through the cracks, making it much easier to stay on track.

- Organization boosts productivity: Once I started using a proper task management tool, I found I had more mental space to focus on important work rather than worrying about what I might be forgetting.

This ultimately improved my efficiency and output. Even though I was embarrassed back then, I am glad I went through it anyway…

Because I learned something important. And now you know too…

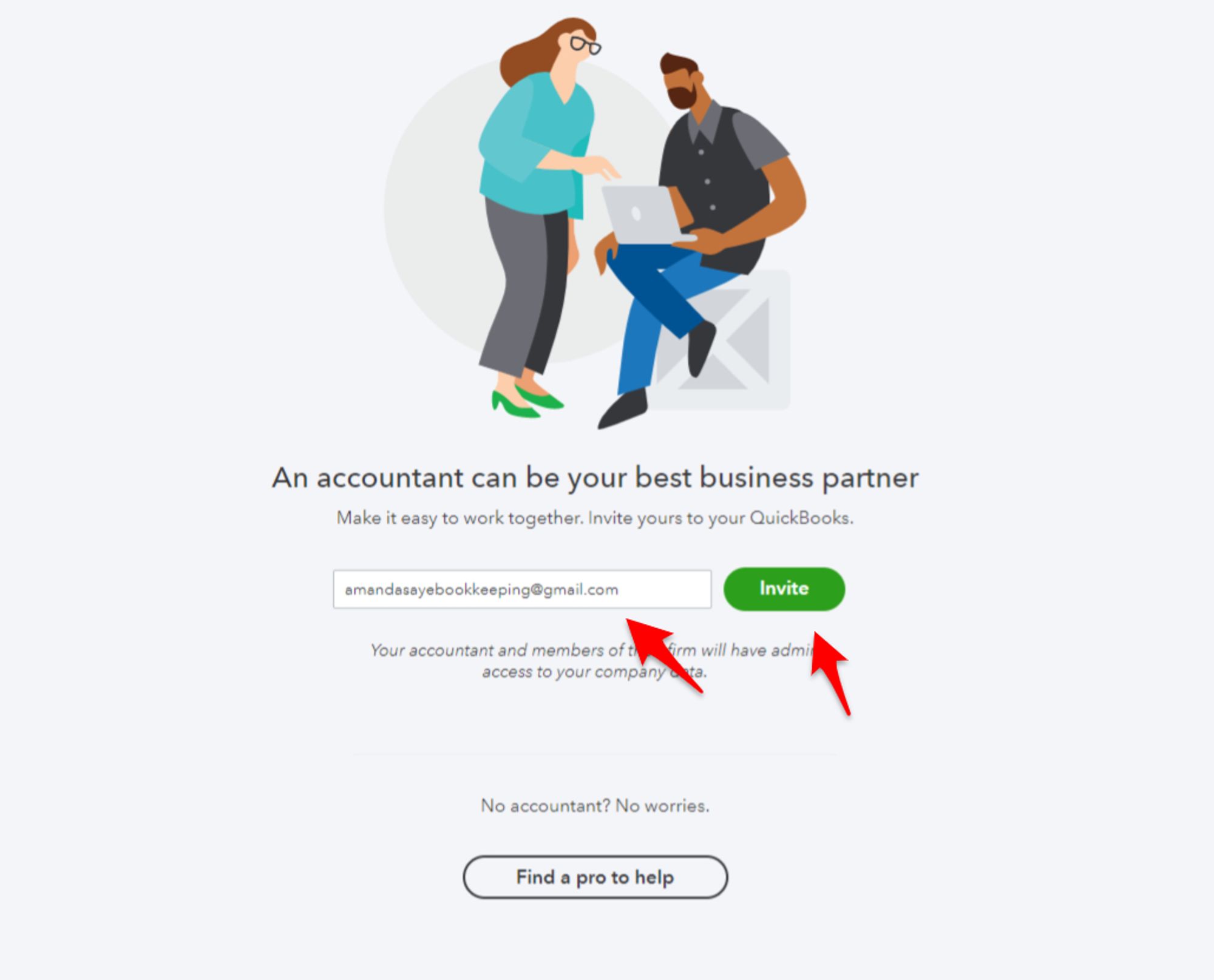

—Amanda Saye

PS: New to bookkeeping for your small business? Get my Beginners Guide to Bookkeeping

Recent Comments