The Accounting Field

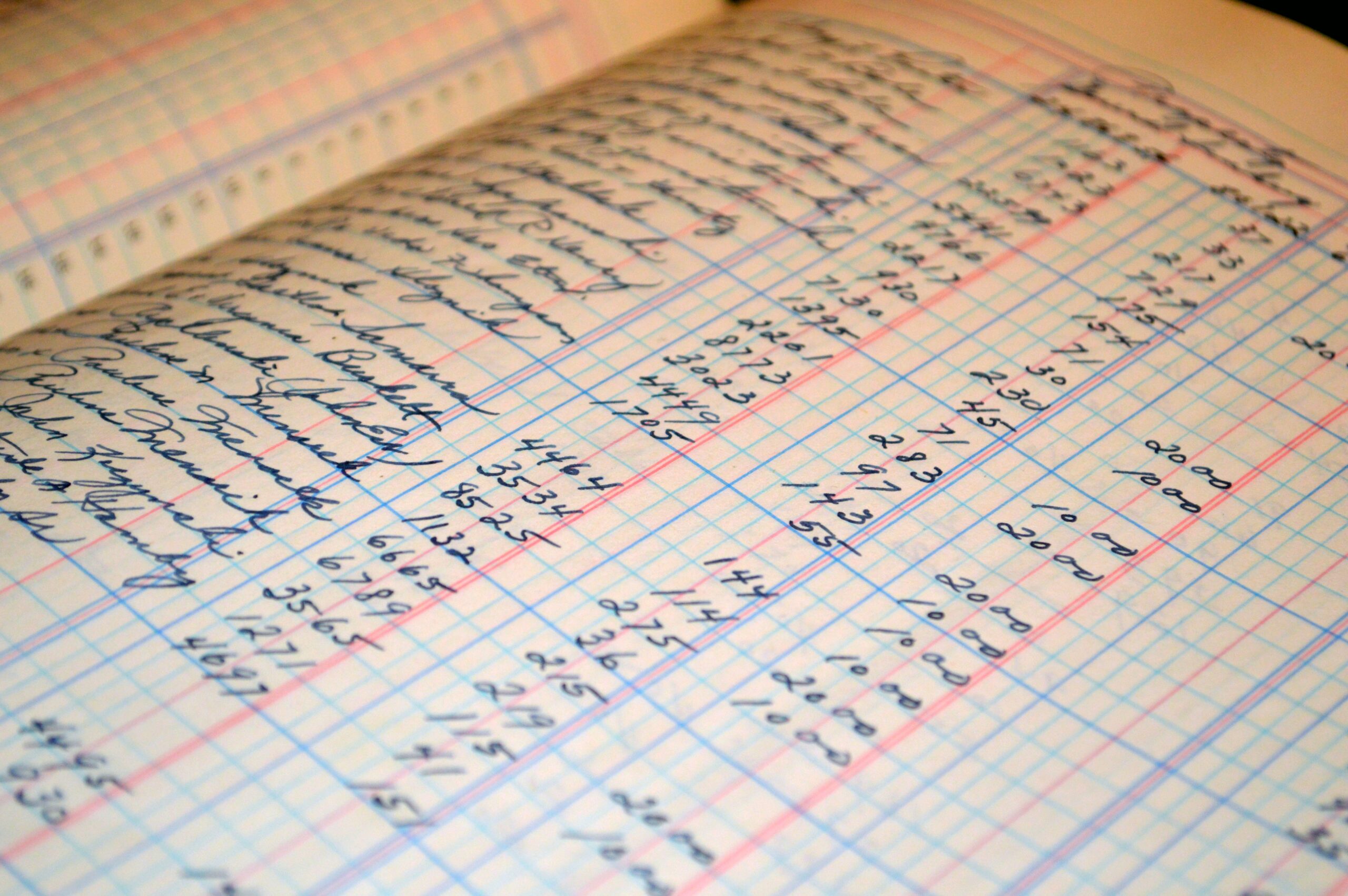

A bookkeeper and accountant work with financial records, but they have different roles and responsibilities within an organization. Here are some key differences between the two:

- Scope of work: Bookkeepers typically focus on the day-to-day financial transactions of a business, while accountants may take on a wider range of financial tasks, such as preparing tax returns, developing financial strategies, and providing financial advice.

- Level of education and training: Accountants typically have more education and training than bookkeepers. I

- Role in the organization: Bookkeepers may work as part of a team or independently, while accountants may hold higher-level positions within an organization and have supervisory responsibilities.

- Relationship with clients: Bookkeepers may have a more hands-on role with clients, working closely with them to track and manage their financial records. Accountants may have more of a consultative role, providing financial advice and guidance to clients.

Overall, the main difference between a bookkeeper and an accountant is the level of education, training, and responsibility. While bookkeepers handle the day-to-day financial transactions of a business, accountants have a broader range of skills and responsibilities and often work at a higher level within an organization.

The Accounting Field, Uncategorized

Here are some of the things that financial reports can tell you:

- Income: Financial reports, such as income statements or profit and loss statements, can tell you how much money a business is making.

- Expenses: Financial reports can also tell you how much a business spends on various expenses, such as salaries, rent, and utilities.

- Profitability: Financial reports can tell you whether a business is profitable by comparing income and expenses.

- Cash flow: Financial reports can show how much cash a business has and how much cash flows in and out of the company.

- Assets: Financial reports can provide information on a business’s assets, such as property, equipment, and inventory.

- Liabilities: Financial reports can also tell you about a business’s liabilities, such as loans or outstanding payments.

- Equity: Financial reports can show how much equity a business has, representing the portion of the company that shareholders own.

Financial reports provide a snapshot of a business’s financial situation, which can help make decisions about investing, lending, or doing business with that company.

The Accounting Field

Do you need help understanding your balance sheet? Do terms like “assets” and “liabilities” make you want to hide? Let’s explore this fascinating document; hopefully, you will understand it better!

Your balance sheet is the financial statement showing the assets, liabilities, and equity of your business at a specific point in time. It is a snapshot of your business’s financial health.

The balance sheet is divided into three main sections:

- Assets are what your business owns: cash, inventory, and property.

- Liabilities are what your business owes, including loans, accounts payable, and taxes owed.

- Equity is what’s left over after you subtract your liabilities from your assets and represents the value of your business to its owners.

A clear picture of your assets and liabilities can determine the net worth of your business. This information is needed to secure funding, sell your business, and apply for loans.

Balance sheets help you track your business’s financial health. If you compare your current balance sheet to previous ones, you can see if your business is growing or shrinking. This report also helps you identify areas where you may need to improve, such as reducing your liabilities or increasing your assets.

Having more assets than liabilities means that your business is financially healthy. On the other hand, too many liabilities mean that you may need to find ways to reduce them, like paying off debts or negotiating better payment terms. The opposite is true, too; too few assets means you must find ways to increase them, like investing in new equipment, creating new services or products, or getting more sales.

The balance sheet may seem intimidating, but it’s vital to understand if you want to have a successful business. When you know your assets, liabilities, and equity, you can make informed decisions that will help you grow and thrive.

The Accounting Field, Uncategorized

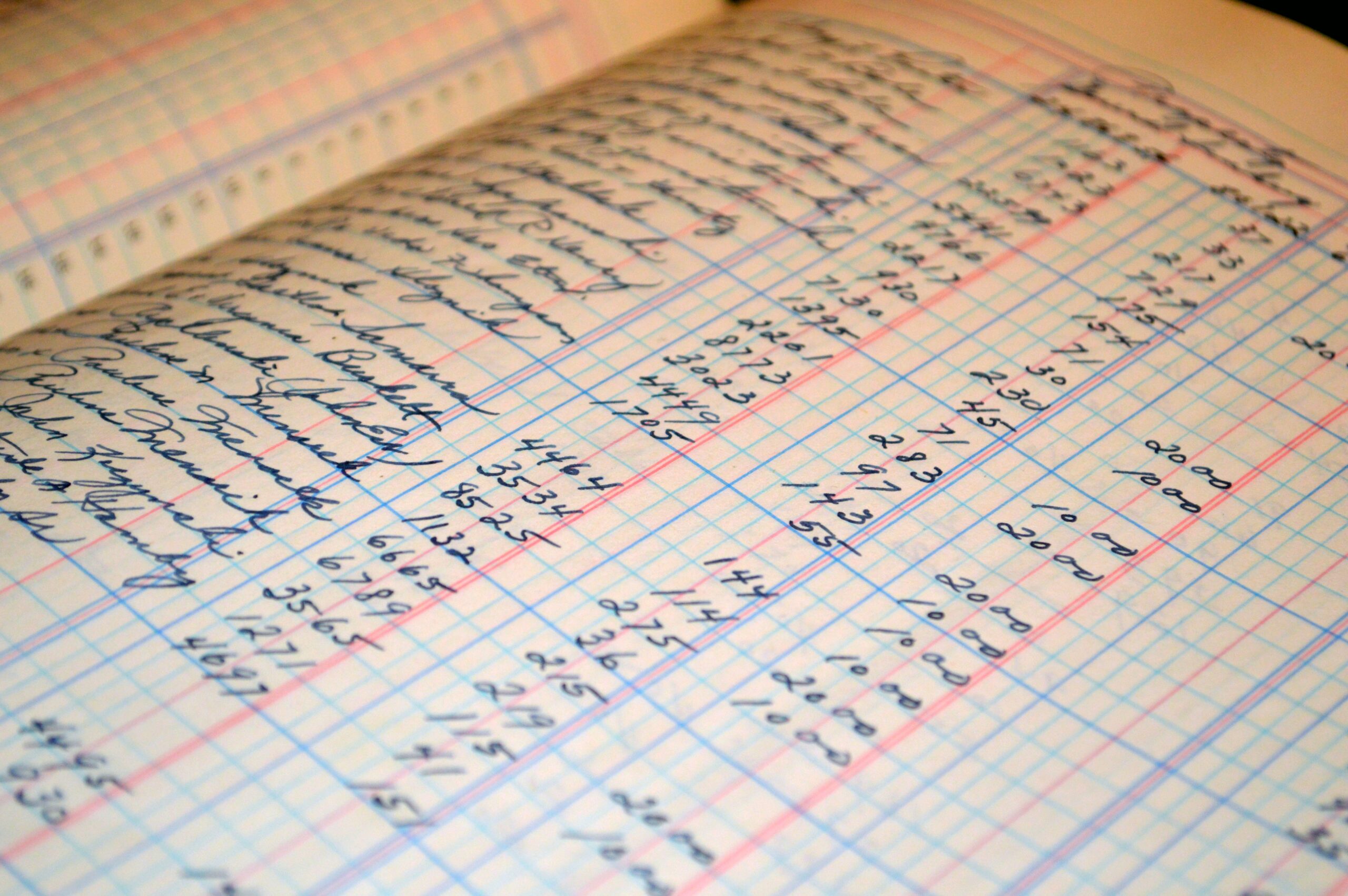

Do you need help to make sense of all the numbers and jargon that come with it? Fear not, my friend, for I, your friendly bookkeeper, am here to break it down for you in a way that’s easy to understand.

So, what is the purpose of a profit and loss statement? Simply put, it’s a financial report that tells you whether your business made a profit or a loss during a specific period of time. It’s also known as an income statement, which is a bit more self-explanatory. Think of it as a report card for your business’s financial performance. Just like you need grades to determine how well you’re doing in school, you need a P&L statement to determine how well your business is doing financially.

This handy report comprises two main sections: revenue and expenses. Revenue refers to the money your business earns from selling goods or services, while expenses refer to the costs incurred in running your business. The difference between the two totals is your profit or loss. If your revenue is higher than your expenses, you have a profit. The other way, you’re losing money.

I probably don’t need to tell you that this is important. We all want our businesses to make money. The P&L shows in a straightforward report if you need to cut back on expenses or book that cruise.

The P&L statement can also help identify patterns in revenue. For example, maybe you have greater sales during the summer or more expenses in the winter. The P&L can help determine that.

With accounting software like QuickBooks, a Profit and Loss statement is easy to put together, and with a little study and the help of your accountant or bookkeeper, you can make informed decisions that will help you grow and succeed.

Recent Comments